A scientific approach to estimating the size of Bitcoin bubbles

We have made the case in previous articles that Bitcoin behaves over the long term as a power law in time.

https://medium.com/@giovannisantostasi/the-bitcoin-power-law-theory-962dfaf99ee9

Given power laws have scale-invariant properties this allows us to be strongly confident in making predictions over the next change in an order of magnitude or two given Bitcoin has been scale invariant for almost 9 orders of magnitude (if we include some of the earliest known US to Bitcoin transactions, where 1 USD was exchanged for 10,000 Bitcoins).

See this video where we explain the relevance of scale invariance in making predictions.

The other important property of Bitcoin that makes it predictable is periodicity. A system that has strong, known periodicities is also amenable to predictions.

Bitcoin demonstrates precise regularities over a 4-year period, or a Bitcoin cycle. These periodicities are associated with the halvings.

The halvings are usually followed by a more bullish than usual period that lasts about one and a half years. To understand the importance of cycles in Bitcoin please watch this video:

About 1 and a half years after the halving large deviations from the general power law trends are observed corresponding with a local maxima or the peak of the cycle. The price then crashes pretty fast for about another year to reach a minimum or bottom level for the cycle. The price slowly increases again until the next halving and the cycle then repeats.

This particular sequence happened 3 times in the 15-year history of Bitcoin with very similar patterns.

There is a pre-halving bubble that is not associated with any halvings. It happened in the 4 years after the birth of Bitcoin before the first halving ever happened. This bubble has irregular behavior relative to the other ones (the timing, the height of the bubble, and other details) so we will exclude it from the analysis.

It is easily seen by observing Bitcoin price action that the height of the peaks seems to decrease in time. A natural way to estimate this height is to observe the change from the regular bottom of the trend.

It is natural to ask if there is a particular pattern in this reduction of the height of the peaks.

This has been done many times in the past but a particular recent attempt that caught my attention is by Peter Brandt @PeterLBrandt on X.

https://www.peterlbrandt.com/does-history-make-a-case-that-bitcoin-has-topped/

In the article, it is claimed that Bitcoin has reached its local maximum and is bound to crash to $30K in the coming weeks.

This statement goes against everything we know about the cyclic nature of Bitcoin.

We have just passed the halving time and we are in what can be considered spring in the Bitcoin 4 season cycle (the summer end is the top, the autumn end at the bottom, the winter end is the transition from bear to bull market, and the spring end is the transition to full bull market in the polar chart below or the Bitcoin clock).

If you want to think in terms of clock times instead 12 is the top, 3 is the bottom, 6 the transition from bear to bull market, 9 is the transition to full bull market.

We are barely after 6 and not yet in the full bull market and very far off from the time when tops usually manifest in the cycle.

Peter Brandt’s conclusion derives from the following observation.

If we measure the change from bottom to top for each cycle (he included the pre-halving period that we are going to exclude because of the reasons explained above) then we can derive the following table:

It seems that there is a reduction in height when expressed as a percentage change from the bottom, by a factor of 5 at each cycle. We have only 3 data points if we exclude the pre-halving period and actually only 2 data points if we consider the ratios. This is hardly enough data to do any significant statistical analysis. But given this is all we have it is an acceptable approach if we want to make some educated estimates about the next possible Bitcoin bubble size.

So if one takes at face value the above table one would arrive to the conclusion that the current cycle will see only a factor of 4.5x from the bottom of the historical cycle bottom of 16,500 dollars, i.e. the top should be around 70,000 dollars. Given that we have already reached such a value the conclusion would be that we have already reached a peak so it is just down from here on.

Besides the already observed problem with cycle timing, we have another problem. This analysis doesn't take into account the long-term power law trajectory of Bitcoin.

There is about 3 years between the bottom and the top. In these years there is substantial movement along the power law trajectory and then usually 1 year of the full bull market.

We can use the app Desmos. com to make sense of this.

https://www.desmos.com/calculator/tpq9jbbtzz

The formula already entered in the app tells us the power law estimated price given a particular day after the Genesis Block (GB). The bottom for the first cycle should have happened at about 3 years after the GB giving us a trend value of about 0.46 dollars.

The actual Bitcoin value was around 0.3 dollars.

3 years after the bottom we had our first real bubble at a value of 1242 dollars. The ratio between top and bottom then should be closer to 4000x rather than the reported 572x. This breaks the regularity of the pattern of the claimed factor of 5 in the reduction of the peaks from bottom to top.

This is due to measuring bottoms and tops associated with the periodic events in the Bitcoin cycle and not including the pre-halving bubble as a real bubble.

This then demonstrates the arbitrary nature of this method of picking the bottom and tops of the cycle to estimate the size of the peaks.

In addition, the trend value at the time of the peak was close to 100 dollars.

Given the general power law trend it seems more natural to measure the tops as a deviation from the general power law trend. This can be done by calculating the percent difference of the price relative to the power law trend.

The following graph illustrates the percentage difference as a function of time.

One can observe the bottoms are very regular and they seem to happen at about -60 % of the general trend.

The tops seem to show the typical decay we can observe in the regular Bitcoin price action chart.

Let’s measure these deviations and see if we observe a pattern.

Instead of taking ratios let’s see if we can plot these data points and find a pattern. The fast decay suggests an exponential trend that should show up as a straight line in a semilog chart. We fit the data in terms of their peak number instead as a function of time.

Indeed we see a decent fit with a nice R² of 0.96. The Pearson coefficient needs to be at least 0.05 to make the data statistically significant but given we have only 3 data points the relatively small value of 0.12 is promising even if not quite significant at this particular point.

This is all we have after all. So we can extrapolate the decay to the next peak that is about 78 % deviation from the trend or basically close to a factor of 2.

We can go back to the Desmos app and calculate the trend value at the next cyclic top which is supposed to be at the end of 2025.

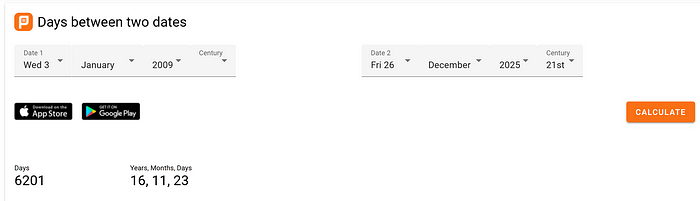

By the way, a nice up to find the days between two dates is the following:

https://planetcalc.com/274/

The uncertainty for the peak can be up to 2–3 months but this should give us a rough estimate that is good for our purpose.

So we have about 6201 days between Jan 3 2009 (Genesis Block) and the projected 4 cycle top.

Let’s plug in this in the Desmos app:

The app indicates a trend value of about 118,066 dollars.

So the estimated top is:

Top=118,000+78/100* 118,000=210,000 dollars.

So this seems a scientifically valid way to estimate the top of the cycle if everything else stays the same as before.

We also added the estimate of the bottom which is usually 50 % or slightly less than the trend historically. The power law Theory is much stronger in predicting the bottoms than the tops.

The trend value is close to 165000 dollars and the bottom should be about half of this value. Rounding to the next integer we have.

Bottom of the next cycle=165,000*0.5 = 83,000 dollars.

These are rough estimates but they are in line with our full model that tries to include the general power law trend, the hard 50–60 % bottom, sinusoidal 4-year period oscillations, and an exponential decay similar to the one calculated above.

See the figure below:

Conclusion:

These of course are rough estimates but based on our understanding of the scaling properties of Bitcoin and its very reliable (so far) periodicity. These predictions should be taken with care but hopefully are useful for the Bitcoin investor.

PS

This is not financial advice of any kind and only a scientific exploration of Bitcoin data.